2022 Tax Info

What is my tax bracket for the 2022 tax year?

| Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | Up to $10,275 | Up to $20,550 | Up to $10,275 | Up to $14,650 |

| 12% | $10,276 to $41,775 | $20,551 to $83,550 | $10,276 to $41,775 | $14,651 to $55,900 |

| 22% | $41,776 to $89,075 | $83,551 to $178,150 | $41,776 to $89,075 | $55,901 to $89,050 |

| 24% | $89,076 to $170,050 | $178,151 to $340,100 | $89,076 to $170,050 | $89,051 to $170,050 |

| 32% | $170,051 to $215,950 | $340,101 to $431,900 | $170,051 to $215,950 | $170,051 to $215,950 |

| 35% | $215,951 to $539,900 | $431,901 to $647,850 | $215,951 to $323,925 | $215,951 to $539,900 |

| 37% | $539,901 or more | $647,851 or more | $323,926 or more | $539,901 or more |

Should I take the standard deduction or itemized deduction?

Well, it depends. You should itemize if your medical and dental expenses + interests paid (home mortgage) + gifts to charity + casualty and theft losses + property taxes paid = more than your standard deduction.

| Filing Status | 2021 | 2022 |

|---|---|---|

| Single | $12,550 | $12,950 |

| Married Filing Jointly | $25,400 | $25,900 |

| Married Filing Separately | $12,550 | $12,950 |

| Heads of Household | $18,800 | $19,400 |

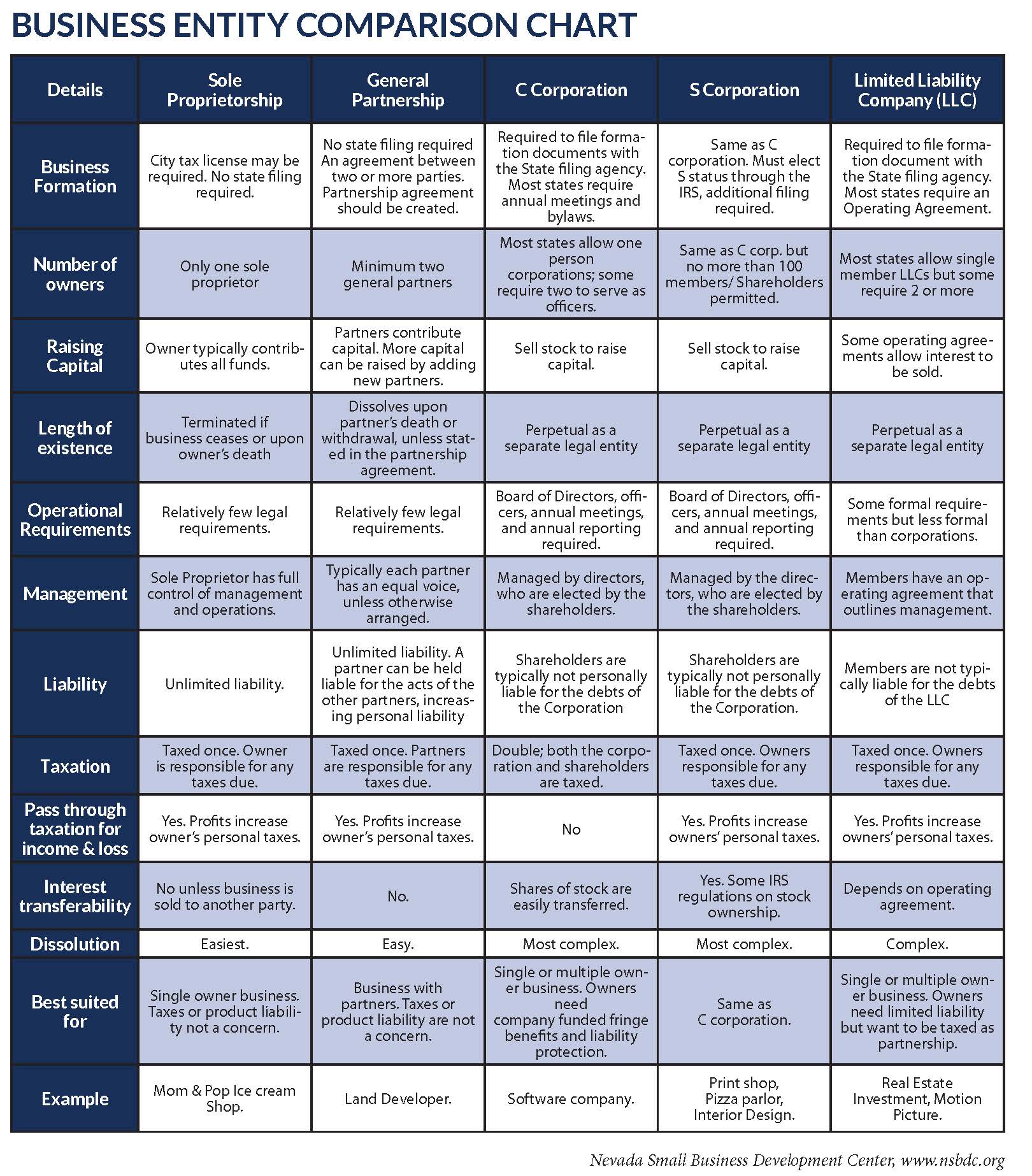

I have started a new business, should I register an LLC?

Opening a business entity could provide you with liability protections, and tax advantages for you and your business. Talk to one of our tax professionals to see what’s right for you.

I completed my tax return somewhere else or by myself, can you review it for me?

Yes, our team of tax professionals will provide a quote to review your tax return and examine if any changes are needed.

What is an ITIN and do I need one?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN).

If you are generating income in the United States and do not have a social security number an ITIN gives you the ability to record that income.